betterment tax loss harvesting white paper

Your 1099-B reflects your total net. The decades-old practice known as tax-loss harvesting or strategically taking investment losses to offset income is a perfectly legal maneuver that doesnt so much dodge.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Taxes Summary.

. As mentioned previously if you invest with Betterment they are required by law to disclose your tax information to the IRS. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss Harvesting. 1 selling securities that have lost value.

In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF investments and how its program works better than an. Betterment Cash Reserve is offered by Betterment LLC. In simplest terms tax-loss harvesting is a process of selling investment assets that have lost value in the year to claim those losses against gains for tax.

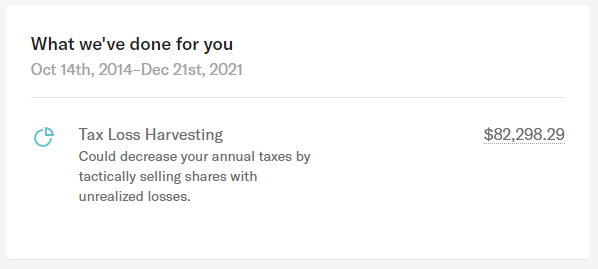

Tax-Loss Harvesting also takes advantage of the difference between your current and future tax rates a practice known as tax-rate arbitrage. Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. Betterment and Wealthfront made harvesting losses easier and more.

Our actual results demonstrate that Tax-Loss Harvesting. What is tax-loss harvesting. In this paper we demonstrate that investment outcomes resulting from equity-based tax- loss harvesting vary significantly.

As the results show while the benefit of tax loss harvesting is positive it is not huge and is far smaller than tax alpha calculated based on single-year tax savings alone. This white paper summarizes the motivation design and historical results of Wealthfronts daily Tax-Loss Harvesting service. Your TLH harvests are simply recorded losses that are netted against any other gains and losses that were realized from the sale of shares.

One approach to deriving more tax alpha is to harvest losses throughout the year because harvesting opportunities can be fleeting. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Advisory services provided by Betterment LLC an SEC-registered investment adviser.

If you read the fine print on the study behind those numbers youll find it took place from 2000 to 2013 which was a really great period of time for tax loss harvesting because there were two. Tax-loss harvesting has been shown to boost after. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits.

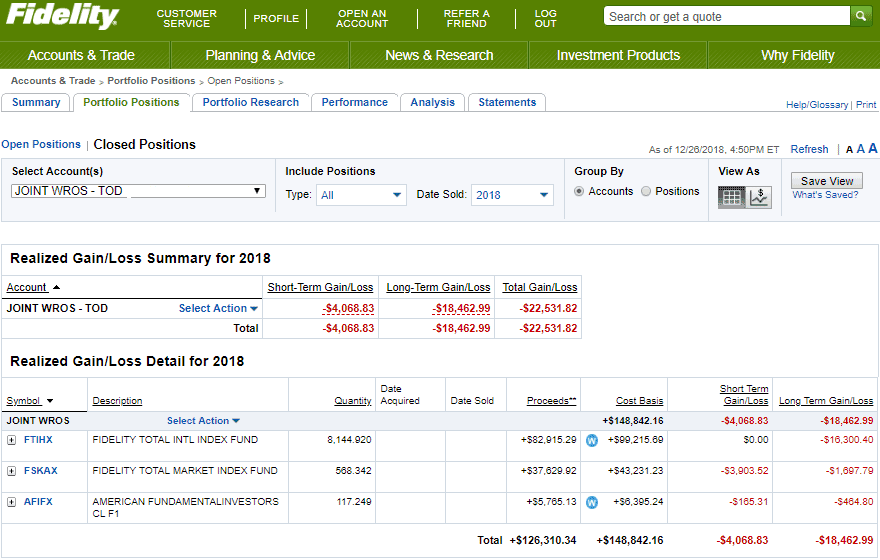

A sophisticated fully automated service for Risland Capital customers. This can create short-term capital gains tax that may dramatically reduce the. 2 using the capital loss to offset capital gains on other sales.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Based on what I have read it appears like Betterments main purpose is to rebalance portfolios and the tax loss harvesting component is a secondary feature. The three steps in the tax-loss harvesting process are.

For example in 2009 the Russell 3000 Index. Recently many personal finance and investment websites have made the general public aware of a concept known as tax-loss harvesting. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

In this white paper we introduce Risland Capitals new Tax Loss Harvesting TLH. There is a chance that trading attributed to tax loss harvesting may create. This is something to be aware of when tax season.

Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period has passed.

Are Betterment Returns Higher After Taxes Https Investormint Com Investing Betterment Returns Higher After T How To Get Money Money Affirmations Money Cash

Tax Loss Harvesting Is Overrated Frugal Professor

![]()

Are Betterment Returns Higher After Taxes Https Investormint Com Investing Betterment Returns Higher After T How To Get Money Money Affirmations Money Cash

The Case Against Tax Loss Harvesting White Coat Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

White Paper Tax Loss Harvesting Risland Capital

Tax Loss Harvesting With Fidelity A Step By Step Guide White Coat Investor

White Paper Tax Loss Harvesting Risland Capital

Calculating The True Benefits Of Tax Loss Harvesting Tlh

White Paper Tax Loss Harvesting Risland Capital

Tax Loss Harvesting With Fidelity A Step By Step Guide White Coat Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Top 5 Tax Loss Harvesting Tips Physician On Fire